Direct express cardless benefit access phone number Fundamentals Explained

Print Wells Fargo Checks Online Without Extra Bank Fees

The smart Trick of Wells Fargo outage: Bank apologizes as stimulus checks arrive That Nobody is Talking About

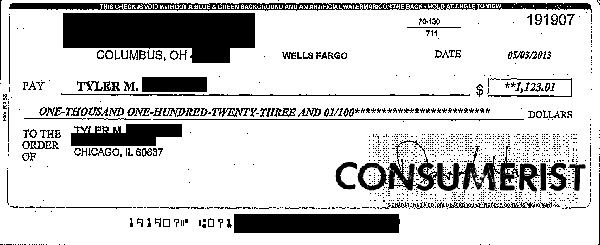

"These subtleties produce timing concerns so that oftentimes our lenders can not see what the real status of that particular item is at any offered time." In the end, the bank made a quasi-human choice, offering to reimburse the consumer the $31 cost it had actually charged for not stopping payment on his check.

"With the automated stuff we have today, it needs to have been a piece of cake. If they can't manage a basic stop payment request, how can they handle anything else?" Editor's Note: This short article originally appeared on Consumerist.

Routing & Account Number Information for Your Wells Fargo Accounts - Wells fargo account, Wells fargo, Wells fargo checking

Highlights Neighborhood Rating Mostly not suggested Cashback Benefits N/A APY (Annual Portion Yield) 0% Month-to-month Fee $0 - $10 Minimum Balance to Prevent Monthly Fee Beginning at $500 Wells Fargo Everyday Bank Account Evaluation Wells Fargo Everyday Bank account is offered by Wells Fargo Bank, a bank founded in 1852 and based in San Francisco, CA.

Rumored Buzz on Hi I deposited a check for $7,000 and Wells Fargo Bank put a

Key Takeaways 0% APY. As with I Found This Interesting inspecting accounts, Wells Fargo Everyday Bank Account does not pay interest. Charges a regular monthly cost. This account charges a monthly service charge of as much as $10, however the cost is waived if you keep a minimum balance of $500 or have a monthly direct deposit of $500.

Wells Fargo Everyday Bank Account does not charge fees on ATM transactions within its network however there is a fee of up to $2. 50 for out-of-network ATM deals. Expense pay. Pay your expenses to virtually anybody in the United States through Wells Fargo Bank. Wells Fargo Bank examining Pros & Cons Pros Cons Available in all 50 states.